It is not too late for debt review if a judgment is granted, it will be too late to include the specific account though. To be direct, because it's important… Having a judgment granted against you should be seen as a wakeup call that you have waited long enough and really do need to ask for help.

You are not alone; many consumers only look for debt help when they’ve already received summons letters or court papers. It’s scary, and it should be. It feels like your heart drops into your shoes. This is the exact reason why Sandton Debt Counselling was started. To help, to make sure you are not alone, and to give you the best chance of rehabilitating your financial situation.

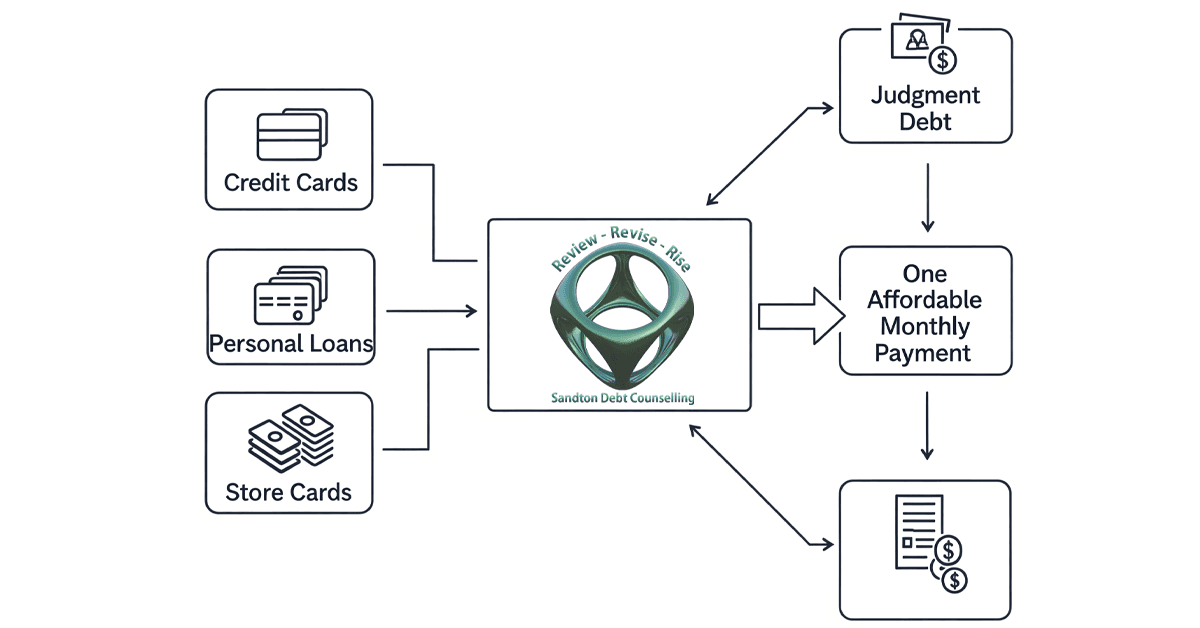

If a court has ruled against you for a specific debt, it becomes a "judgment debt." Under the National Credit Act, once legal action has been finalised and a judgment is granted, that specific agreement is terminated and cannot be included in a new debt review plan.

That means it’s out of the running for the usual restructuring process and it cannot be included and you will have to pay it apart from the program.

But don’t panic yet, there is light at the end of this tunnel.

Even with a judgment, debt review is designed to give your overall budget critical relief and stability. Think of it as creating breathing room where there was none before. Here’s how we help:

Example: Before vs. After joining us

Let's have look at the real-world impact on your cash flow.

Before joining us:

With Sandton Debt Counselling:

No, not at all! The process will still be worth it and it is still a smart choice.

A good debt counsellor will have a holistic look at your situation and build a plan that makes sure your judgment debt gets paid alongside everything else

Once you apply for debt review, your creditors are formally notified. From that point on, they must, by law, communicate with your debt counsellor, not with you. This provides immediate legal protection from creditor harassment, stopping the stressful phone calls and letters of demand. Your debt counsellor becomes your shield, managing all creditor interactions on your behalf.

The sooner you talk to us the sooner we can help you balance things out. Even with a judgment already on the books.

Reach out to Sandton Debt Counselling today. It's time to stop worrying and start taking back control of your finances. Give your budget the professional help it needs to succeed.

Unfortunately not, Judgments stand alone, you pay it separately, but debt review helps by cutting down your other payments so you can still afford to pay the judgment.

Yes, unfortunately, for that specific debt, it is too late. Here is the critical timeline you need to understand:

This is why acting immediately is non-negotiable. The moment you receive a Section 129 letter is the most critical moment to contact us. By applying for debt restructuring before a summons is issued, your counsellor can formally notify that creditor, which legally prevents them from starting the court process.

Even if one debt has gone to summons, debt review is still your best option. While that one debt will have to be handled separately, all your other eligible debts can be restructured, freeing up the vital cash flow needed to manage the summonsed debt and your living expenses.

That’s what the debt counsellor figures out, they make sure there’s enough left for living

so you can keep paying the judgment and not end up eating instant noodles for every meal.

Speak up early, contact whoever’s collecting it and explain why you have to miss the payment. They might be open to a new payment plan. Silence is what gets people into hotter water

Usually around 3 to 5 years as it depends how much debt you’ve got.