If you’ve been searching for debt help, you’ve probably seen it all - the glossy promises, the fear tactics, and the horror stories about people who trusted the wrong hands.

We understand why it’s hard to know who to trust.

That’s why we work differently.

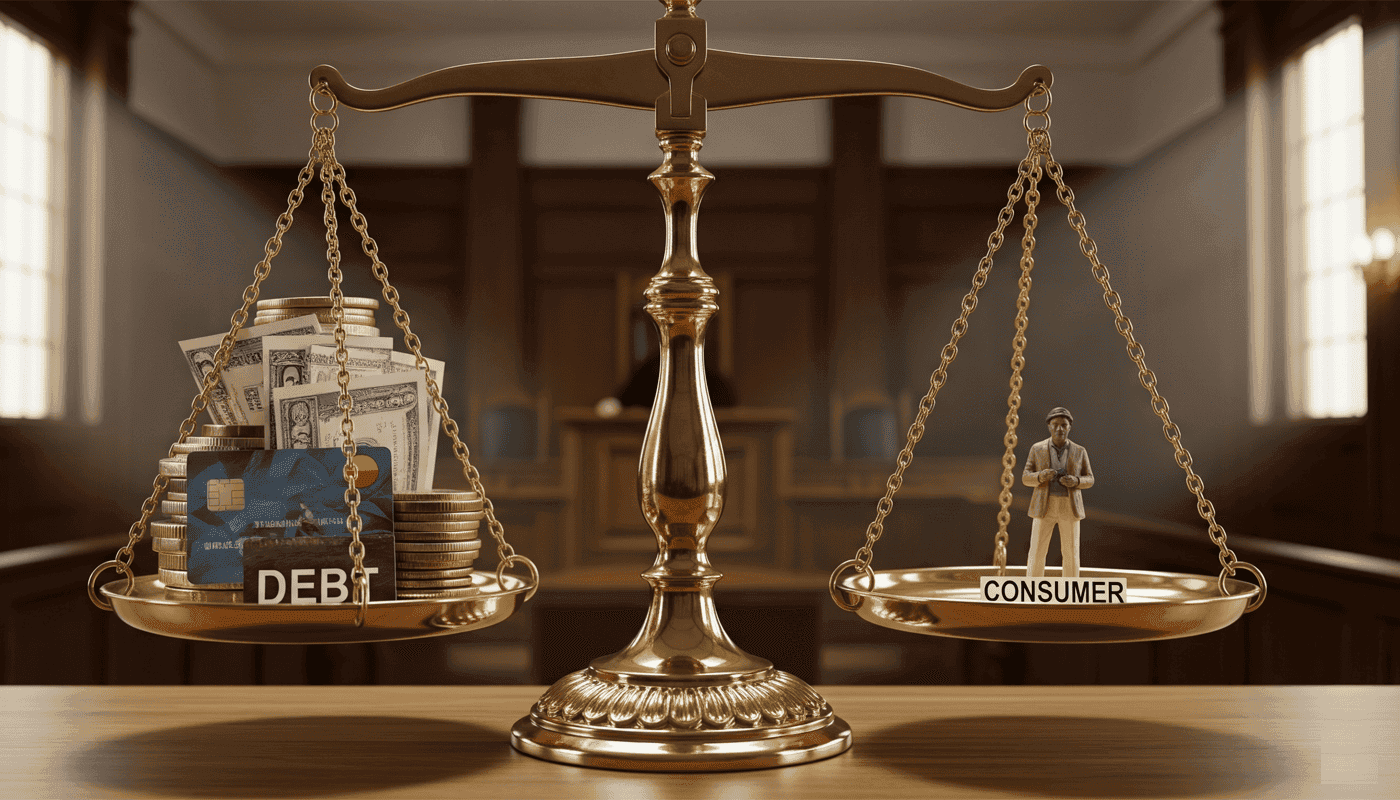

We believe in balance - between your legal rights and your financial obligations, between protecting your pocket while giving you the tools to rebuild.

It’s the same principle that inspired the Lady Justice article on the DCASA website.

Justice isn’t merely about the law and it must stand up to the real concept of fairness. All while ensuring the scales are never tipped against you, simply because you didn’t know your rights.

When Resilience Turns Against You

Resilience is a powerful and admirable trait. It’s what helps people survive challenges and keep going when life is hard.

But sometimes, resilience can turn into quiet self-destruction.

We see it often when people are determined to “fix it themselves” even when the numbers no longer add up. The start hiding their financial struggles from friends, family, and professionals and even believing that asking for help means they’ve failed.

This can be dangerous. Time flies by very fast and before you know it- it’s been six months and the banks have moved on to legal recourse to collect what is owed.

When resilience becomes stubbornness, a few things happen:

You can see how this cycle of keeping all of it together all the time can trap you in a frequency where you stay stuck.

Breaking the Silent Struggle – The Sandton DC Way

We know what the silent struggle looks like.

It’s the late-night mental math you do in bed, wondering which bill you can skip this month without triggering a crisis.

It’s the unopened statements piling up because you already know they’ll make your chest tighten.

It’s nodding along when friends suggest “just talking to the bank” while you think, If it were that easy, I’d have done it by now. We know what it is like to drag yourself out of bed and force yourself to get things done. Especially when the pressure is on.

The real moment of acceptance begins when you realize your financial confidence took a knock. The reality is that life throws a lot of struggles your way and because only you have walked your path, you imagine others won’t understand. We do.

When you come to us, we don’t just hand you a repayment plan -we dismantle the fear that’s been dictating your decisions.

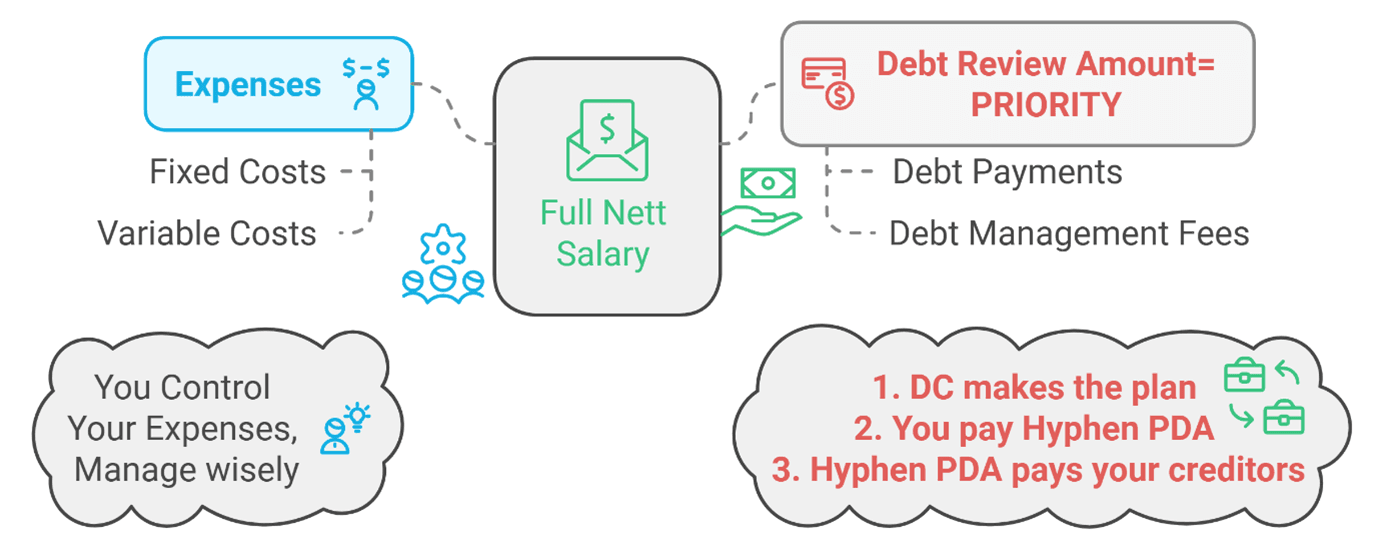

First, we ask you to take a breath, and do a quick Quizz. Because we need some details and a basic idea of your pressures. This grants us permission to draw a credit report- not place you into debt review. When we see that debt review could work for you, we give you some preliminary results to look at. We communicate clearly and you get to make the decision that you feel comfortable with. There are no sales pitch conversations here.

Then, we do what we do best:

We don’t deal in magic wands or quick fixes and that might not be for everyone either. We deal in lawful, strategic, sustainable solutions. Ideal for the people who want

When You’re Ready to Stop Carrying It Alone

You might have been holding the line for months -maybe years -telling yourself you’ll “sort it out” when things calm down.

But debt…doesn’t quietly fade away- it intensifies with added repercussions. It grows louder, heavier, and more urgent.

You don’t have to commit to anything today.

You just need the truth about your options -without judgement, without pressure, and without the smoke and mirrors. Simple.

That’s where we begin.

You already made the first step by reading this. The next step is a bit bigger, but it is time. Contact Sandton DC for a confidential conversation, and let’s put your rights, your dignity, and your financial future back in balance.