The short answer is no. You will not lose your house or car if you apply for debt review. In fact, debt review was designed by the National Credit Act (NCA) specifically to prevent you from losing your assets.

As long as you maintain your new, consolidated monthly payment, your assets are legally protected.

This guide will explain exactly how that protection works, the legal timelines you need to know, and the traps you must avoid.

When you enter debt review, you are placing yourself under the legal protection of the National Credit Act. This creates a "moratorium" (a legal freeze) on your credit providers.

Once your Debt Counsellor officially notifies your creditors that you have applied for debt review (Form 17.1), they are legally blocked from taking legal action against you. They cannot:

This protection remains in place as long as you stick to the restructuring plan agreed upon or ordered by the court.

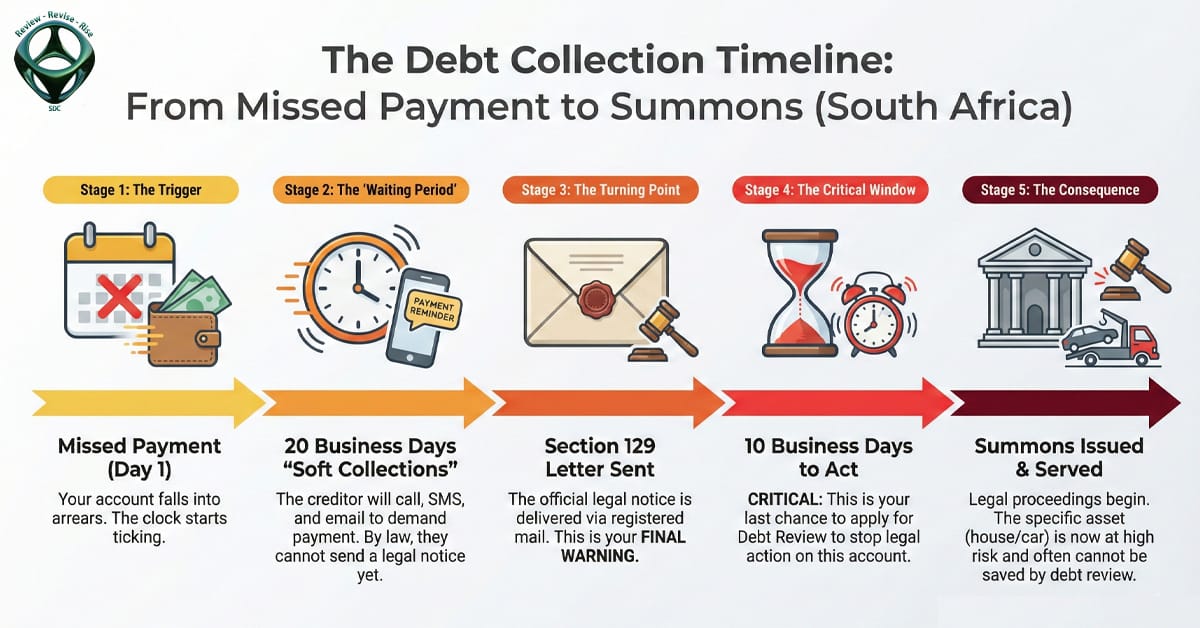

The timing of your action is the single most important factor in protecting your assets.

You cannot place a specific debt under debt review if legal action on that account has already started. In practice, the process begins around the time of the Section 129 Letter of Demand.

A Section 129 letter is a formal notice from your credit provider. It tells you that you are in default and explains your rights. It is the final warning before they sue you in terms of South African law. You must take this letter seriously.

Here is what usually happens:

If you act within these 10 days:

If you ignore the letter for 10 business days:

Do not wait for the letter. If you think you might miss a payment, act immediately.

Cars are the assets most people lose first. Often, it happens because consumers are pressured into giving them up.

When you fall behind on instalments, a debt collector may call or visit you. They may sound helpful and ask you to:

Warning: In many cases, that document is a Voluntary Surrender form under Section 127 of the National Credit Act.

If you sign a voluntary surrender:

Never sign any document from a debt collector without your Debt Counsellor checking it first.

Under debt review, your vehicle is usually safe from repossession, as long as:

Losing a home is traumatic, and the courts treat it seriously.

Section 26 of the Constitution says no one may be evicted from their home without a court order that considers all relevant circumstances. However, if you ignore your bond repayments, the bank can still ask the court to sell your home at auction.

Through debt review, SDC usually:

The bank receives a lower amount each month, but it is regular and backed by a court or tribunal order. With that order in place, the bank must accept the restructured plan and cannot simply foreclose, as long as you pay as agreed.

Debt review at Sandton Debt Counselling includes an investigation into reckless lending.

We check your credit agreements to see whether the credit provider did a proper affordability assessment. If they gave you credit you clearly could not afford, the loan may be reckless.

If a court declares a loan reckless:

This is a powerful legal remedy that you access through the debt review process.

Many consumers worry about “fly-by-night” debt counsellors who take money and disappear.

We were nominated as a top 10 debt counselling firm for three years in a row and ranked in the top 5 in 2024. We do more than file forms. We fight to protect your assets.

Debt review cannot save an asset after a summons has been served on that specific account or after you have signed it away.

Delay is the real danger. The sooner you act, the more legal tools we have to protect you.

Sandton Debt Counselling is ready to assist. You do not have to face the banks alone. Complete the “Call Me Back” form or contact us on 087 550 11 22 for a no-obligation assessment. Let us put legal protection in place before your creditors move to take your assets.